Recovery Loan Scheme (now closed)

The Recovery Loan Scheme (RLS) is designed to support access to finance for UK businesses as they look to invest and grow following the Covid-19 pandemic.

Please note that the closing date for Recovery Loan Scheme applications was 30 June 2024. The scheme has been replaced by the Growth Guarantee Scheme.

The Recovery Loan Scheme aims to improve the terms on offer to borrowers. If a lender can offer a commercial loan on better terms, they will do so.

Businesses that took out a CBILS, CLBILS, BBLS or RLS facility before 30 June 2022 are not prevented from accessing RLS from August 2022, although in some cases it may reduce the amount a business can borrow.

Recovery Loan Scheme-backed facilities are provided at the discretion of the lender. Lenders are required to undertake their standard credit and fraud checks for all applicants.

Recovery Loan Scheme features include:

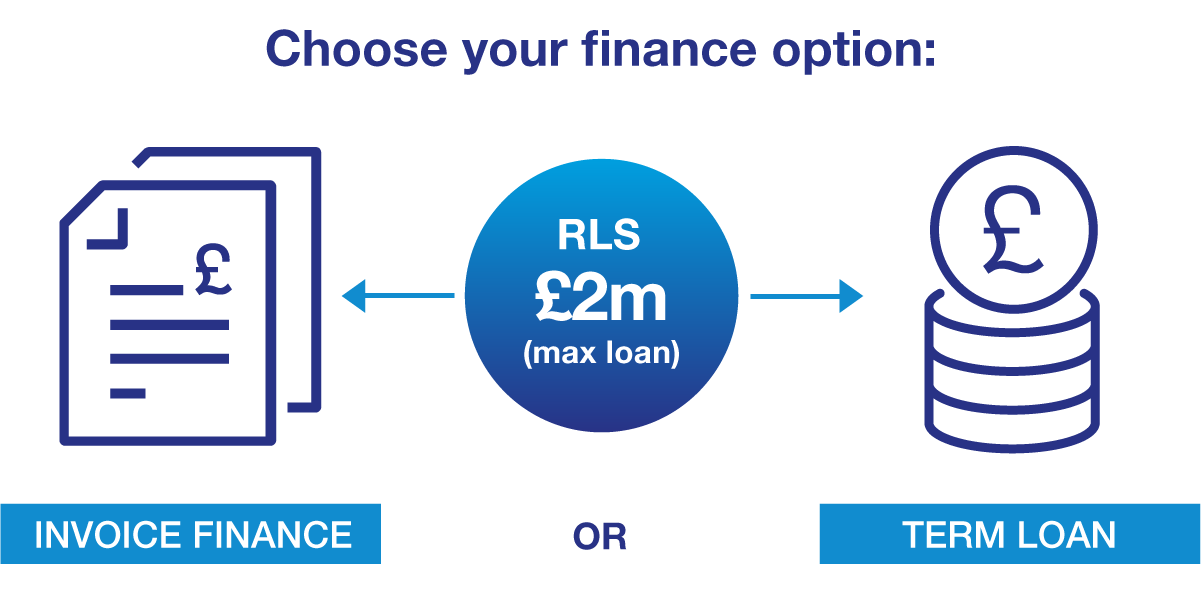

Up to £2m facility per business group: The maximum amount of a facility provided under the scheme is £2m per business group for borrowers outside the scope of the Northern Ireland Protocol, and up to £1m per business group for Northern Ireland Protocol borrowers. Minimum facility sizes vary, starting at £1,000 for asset and invoice finance, and £25,001 for term loans and overdrafts. A borrower in scope of the Northern Ireland Protocol may borrow up to £1m per business group, unless such borrower operates in a sector where aid limits are reduced, in which case the maximum that can be borrowed is subject to a lower cap. These include agriculture, fisheries / aquaculture and road freight haulage.

Term length: Term loans and asset finance facilities are available from three months up to six years, with overdrafts and invoice finance available from three months up to three years.

Personal Guarantees: Personal guarantees can be taken at the lender’s discretion, in line with their normal commercial lending practices. Principal Private Residences cannot be taken as security within the Scheme.

Guarantee is to the lender: The scheme provides the lender with a 70% government-backed guarantee against the outstanding balance of the facility after it has completed its normal recovery process. The borrower always remains 100% liable for the debt.

Subsidy: The assistance provided through RLS, like many Government-backed business support activities, is regarded as a subsidy and is deemed to benefit the borrower. There is a limit to the amount of subsidy that may be received by a borrower, and its wider group, over any rolling three-year period. Any previous subsidy may reduce the amount a business can borrow. All borrowers in receipt of a subsidy from a publicly-funded programme should be provided with a written statement, confirming the level and type of aid received. Borrowers will need to provide written confirmation that receipt of the RLS facility will not mean that the business exceeds the maximum amount of subsidy they are allowed to receive.

Northern Ireland Protocol: All borrowers will need to answer some questions to determine whether they are inside or outside the scope of the Northern Ireland Protocol, to determine the relevant subsidy limit and hence the potential maximum amount they can borrow under RLS.

Is my business eligible?

To be eligible for support via a recovery loan, a business must fulfil the following criteria:

The following sectors are not eligible under RLS:

- Banks, Building Societies, Insurers and Reinsurers (excluding Insurance Brokers)

- Public sector bodies

- State-funded primary and secondary schools

How can I access the scheme through Close Brothers?

If you are an existing Close Brothers Invoice Finance customer, please contact your account manager who will be able to explain the application process.

If you are a new customer interested in applying for both an invoice finance and RLS facility, please call us on 0808 1499318 to speak to one of our funding specialists.

The Recovery Loan Scheme is managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy & Industrial Strategy. British Business Bank plc is a development bank wholly owned by HM Government. It is not authorised or regulated by the PRA or the FCA. Visit http://www.british-business-bank.co.uk/recovery-loan-scheme